When we started Pacific Swing Dance Foundation in 2018, we had little inkling how arduous it would be to achieve federal non-profit status. The process involves delivering hundreds of pages of financial and legal information to the IRS and wading through a sea of tax jargon which, if misunderstood, can dramatically change the legal nature of an organization’s activities. Fortunately, we worked with an outside consulting firm which very patiently helped us navigate the process and we delivered our application on July 8, 2021.

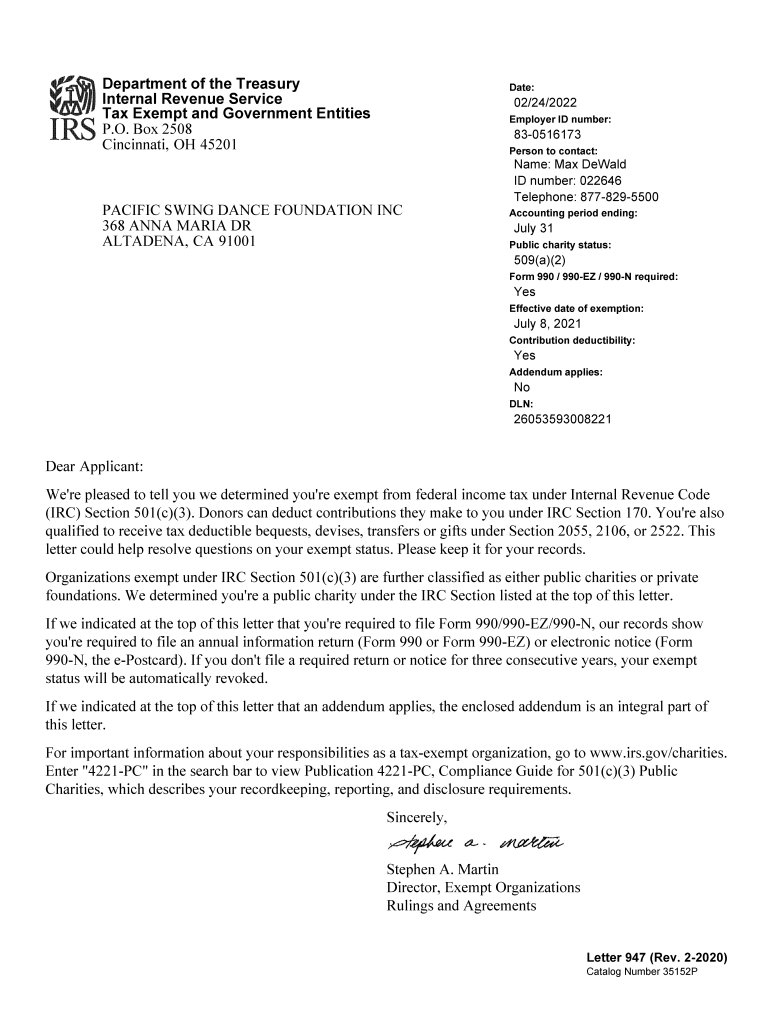

More than 6 months later, we finally received confirmation of our exempt status under Internal Revenue Code section 501(c)(3). This means that contributors may now make tax-deductible contributions to PSDF under IRC section 170. This also opens up a great number of new fundraising opportunities for PSDF–including private and public grants–to help us fund PSDF and do our work of preserving and promulgating the history of swing dancing in the Western US.

Since the start of the pandemic, PSDF raised (or was instrumental in raising) about $185,000 to support swing dance professionals, artists, and organizations. Our work to support and aid artists will continue but 501(c)(3) designation means we can also expand our work providing scholarships to swing dance events, preserving swing dance history, and creating cultural experiences around swing music and swing dancing.

At this moment, PSDF is working with Camp Hollywood to provide scholarships to Camp Hollywood 2022 and we’ve begun planning California Balboa Classic 2023!